Understanding Median Income: What It Represents

Median income is a vital economic indicator that provides insights into the financial well-being of a population. It represents the middle point of income distribution; that is, half of the population earns above this figure, while the other half earns below it. This measure is particularly significant as it helps to portray a more accurate picture of the economic status of individuals compared to mean income, which can be skewed by extremely high or low earnings. Unlike mean income, which is the total income divided by the number of earners, median income focuses on the midpoint, thereby offering a clearer perspective on the income level of the majority.

The calculation of median income is fairly straightforward. In a given income dataset, the values are organized in ascending order, and the median is determined by identifying the middle number. If the dataset contains an even number of values, the median is calculated by averaging the two central numbers. This method ensures that outliers do not distort the representation of income, making median income a more reliable measure of economic health and individual welfare.

Several demographic factors can influence median income levels, including age, educational attainment, and geographical location. Generally, younger individuals tend to have lower median incomes as they are often earlier in their career paths. Conversely, those with higher education levels, such as advanced degrees, are likely to experience higher earning potential, thus raising the median income in a given demographic group. Geographical location also plays a crucial role; for instance, median incomes in urban areas often exceed those in rural regions due to the disparity in job opportunities and living costs. Understanding these factors is essential for a comprehensive analysis of median income trends, particularly in the context of economic conditions during the Biden administration.

The Economic Context of Biden’s Presidency

At the onset of the Biden administration in January 2021, the United States was grappling with the profound economic ramifications induced by the COVID-19 pandemic. The crisis led to significant job losses, with millions of Americans filing for unemployment benefits and many businesses, especially in sectors such as hospitality and retail, facing unprecedented challenges. The resulting economic landscape required immediate and robust intervention to stave off a deeper recession and facilitate recovery.

In response to these urgent economic needs, the Biden administration implemented a series of policies designed to support individuals, stimulate consumer spending, and aid businesses. One of the hallmark legislative actions taken was the American Rescue Plan Act, which included direct financial aid to households, extended unemployment benefits, and funding for vaccination efforts. These measures aimed to alleviate the financial burden on citizens and stabilize the economy by ensuring that consumer spending could resume as public health conditions improved.

Moreover, the administration prioritized infrastructure investment, recognizing that a robust economic recovery would necessitate not only immediate relief but also long-term foundational improvements. The Bipartisan Infrastructure Law was enacted with the intention of modernizing transportation networks, upgrading utilities, and enhancing broadband access, thereby creating jobs and fostering sustainable economic growth. These initiatives were instrumental in influencing median income growth as they created opportunities for employment and increased economic activity across various sectors.

Overall, the economic context of President Biden’s tenure reflects a tumultuous transition from a pandemic-driven economy to the beginning of a recovery phase. The strategic policies enacted during this period were critical in addressing the immediate crises and setting the stage for future economic stability, ultimately shaping the trajectory of median income growth in the United States.

Analysis of Median Income Changes During Biden’s Term

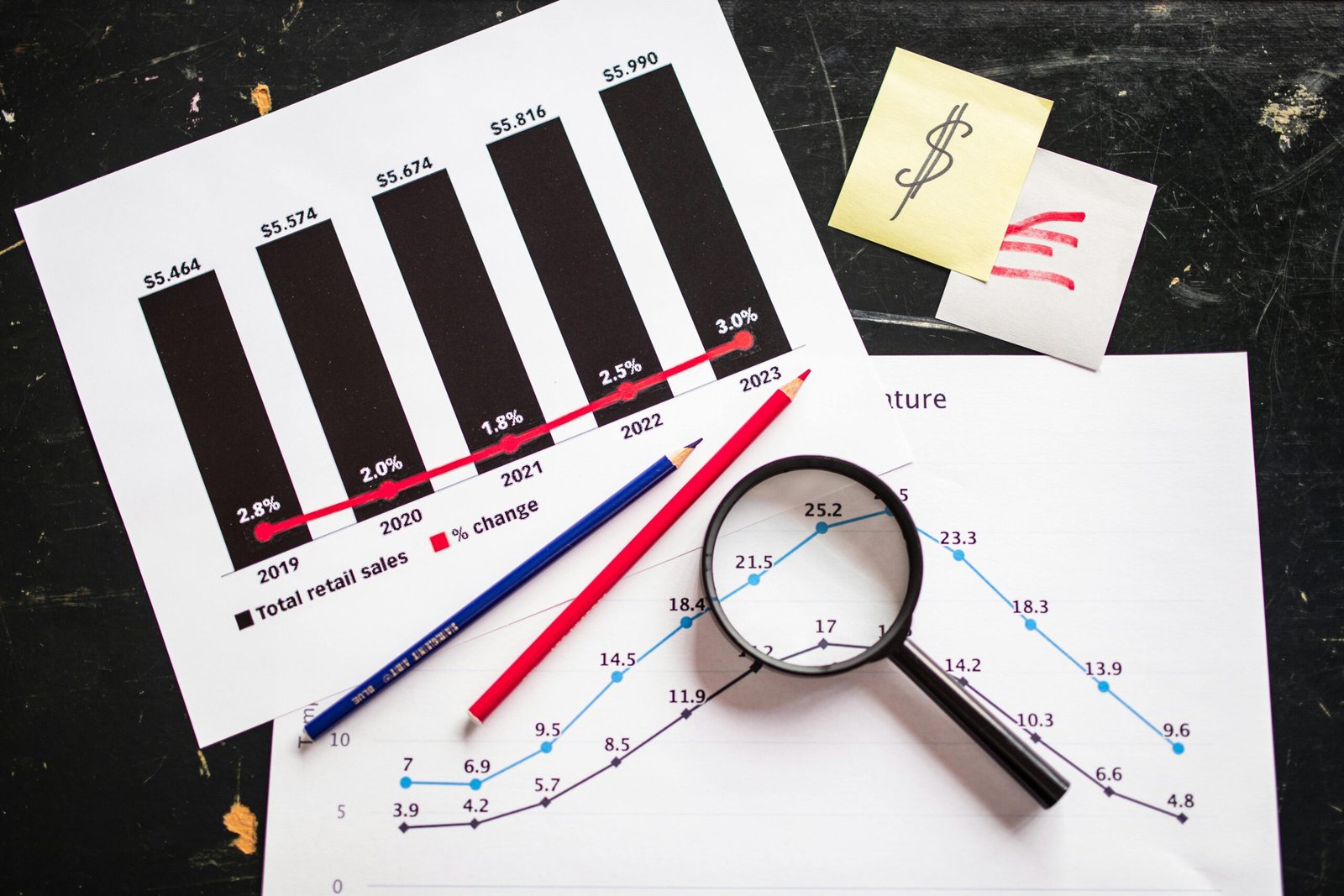

Since the onset of the Biden administration in January 2021, median income levels within the United States have experienced notable shifts. According to data from the U.S. Census Bureau, median household income has seen a gradual increase, rising from approximately $67,521 in 2020 to around $70,000 by mid-2023. This uptick reflects the administration’s efforts to stimulate economic recovery following the severe disruptions caused by the COVID-19 pandemic. Key initiatives, such as the American Rescue Plan, aimed to provide direct financial assistance to families, thereby contributing to an increase in consumer spending and, subsequently, income levels.

However, it is important to contextualize these income changes by comparing them to pre-Biden figures. Prior to his presidency, median household income had been gradually increasing, climbing from about $61,937 in 2019. Although the upward trend continued during Biden’s term, external factors like inflation have posed challenges to the real purchasing power of households. The inflation rate surged to levels not seen in decades, with various prices, particularly for essentials like food and gas, significantly impacting household budgets.

In addition, the labor market dynamics have evolved during this period. The job market initially experienced a significant rebound as businesses reopened. This resurgence benefited several sectors, including retail and leisure, contributing to wage growth in those areas. Conversely, some industries, such as manufacturing, faced supply chain interruptions that hindered wage growth and employment stability.

The analysis of median income growth during the Biden administration reveals a complex interplay between governmental policies and external economic factors. While income levels show an encouraging trend, it is crucial to recognize the broader context, including the persistent effects of inflation and the uneven recovery across different sectors. Understanding these nuanced dynamics is essential in evaluating the overall economic health under Biden’s leadership.

Implications and Future Outlook for Median Income

The recent trends observed in median income during the Biden administration carry significant implications for American households and the broader economy. A steady increase in median income can lead to improved consumer behavior, as individuals and families experience heightened disposable income. This increase typically encourages higher spending levels, which can stimulate economic growth. When households have more money to spend, they are likely to invest in essential goods and services, thereby supporting local businesses and contributing to job creation.

Moreover, the rise in median income can influence saving patterns. Households with increased earnings may prioritize savings and investments, thereby strengthening their financial stability. This shift could lead to an enhancement in overall wealth accumulation, allowing families to plan for future endeavors such as education, home ownership, and retirement. Improved savings rates also add to the resilience of the economy, as financial institutions benefit from higher deposits and a more robust borrowing capacity.

Looking ahead, the prospects for median income growth depend significantly on the implementation of effective economic policies. Policymakers may consider measures aimed at enhancing income potential through investments in education, workforce training, and infrastructure development. These strategies are imperative in creating sustainable job opportunities and equipping individuals with the skills needed to thrive in a rapidly evolving job market.

Nonetheless, various political and economic challenges could impede this optimistic outlook. Factors such as inflation, shifts in the labor market, and geopolitical uncertainties may complicate efforts to sustain or accelerate income growth. Additionally, legislative changes could significantly impact tax structures and social welfare policies, influencing households’ financial situations. In conclusion, the trajectory of median income will be influenced by multiple variables, and ongoing assessment will be crucial to understanding its long-term implications for American families and the economy.