Current Trends in Jobless Claims

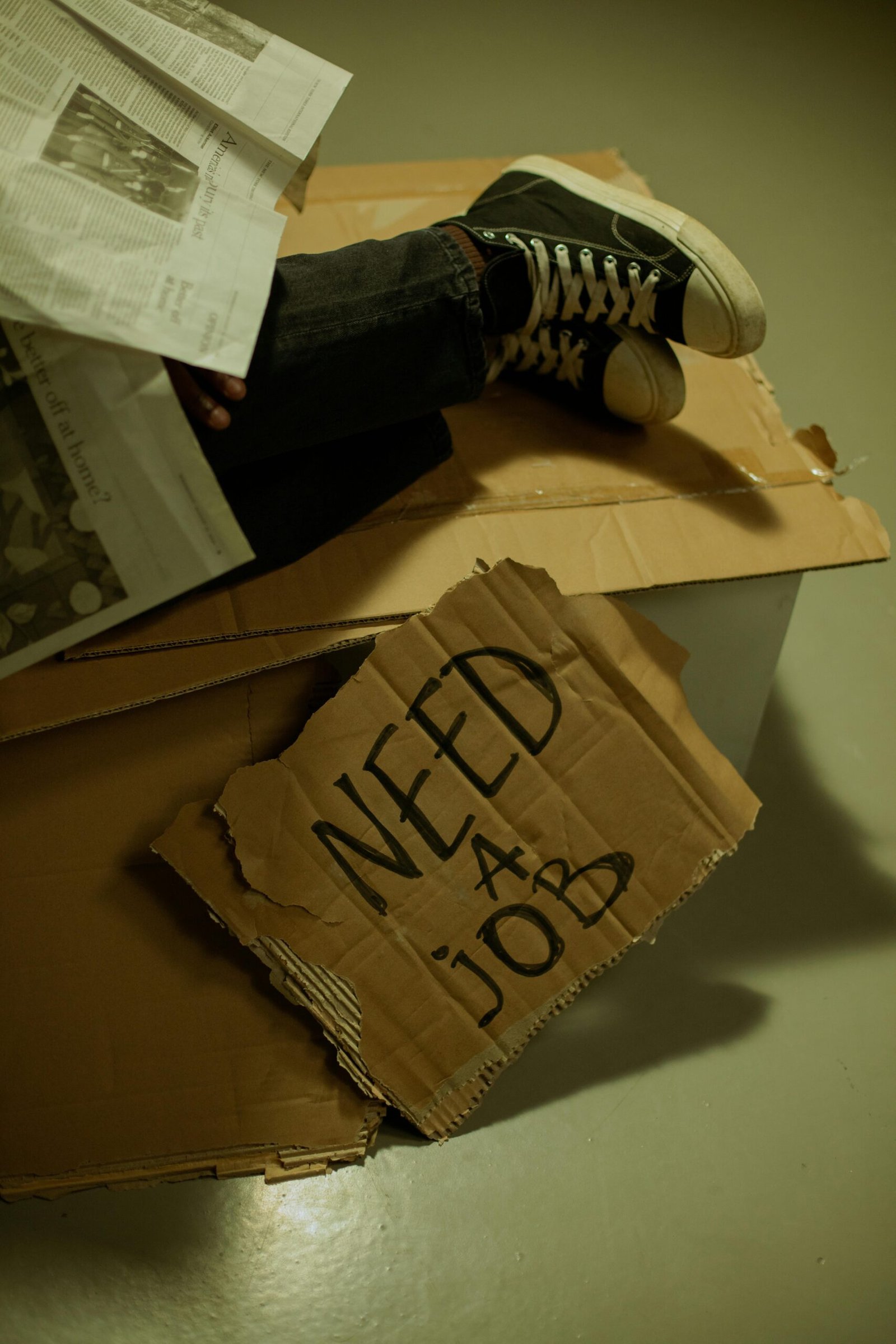

Recent data indicates a notable rise in jobless claims within the United States, signaling potential turbulence in the labor market. As of the latest report, initial claims for unemployment benefits have increased, reflecting growing economic uncertainties that affect various sectors. The current weekly average of claims has reached levels not seen consistently since prior to the pandemic, hinting at underlying issues that may concern both job seekers and policymakers.

The increase in jobless claims can be attributed to several factors. One of the primary contributors is the wave of layoffs in industries that have recently struggled to maintain stability amid volatile market conditions. Sectors such as technology and retail have reported significant reductions in their workforces, resulting in a higher number of individuals filing for unemployment benefits. Furthermore, seasonal adjustments to employment figures have also played a role, as many companies anticipate fluctuating demand in the upcoming months, leading to temporary or permanent reductions in staffing levels.

Historically, jobless claims tend to rise during times of economic uncertainty, and the current situation aligns with these trends. For instance, during previous economic downturns, initial claims spiked as businesses adjusted to declining consumer demand. This reflects a pattern where job seekers may find it increasingly difficult to secure employment opportunities. As the economy grapples with changing dynamics influenced by inflationary pressures and interest rate hikes, this dilemma is likely to persist. Additionally, the rise in jobless claims could ultimately impact consumer confidence, affecting spending behaviors and overall economic growth.

Understanding these trends is essential for job seekers navigating the current landscape, as they may need to adapt their strategies in response to an increasingly competitive market. The implications of rising jobless claims extend beyond individual impact, also affecting the broader economy and its recovery trajectory.

Understanding Private Payrolls and Their Growth Dynamics

Private payrolls refer to the number of jobs in the private sector, excluding governmental roles, and serve as a critical indicator of economic health. They encompass a vast array of industries, such as services, manufacturing, and agriculture, reflecting the overall employment landscape. The growth dynamics of private payrolls are essential as they provide insights into hiring trends, consumer spending, and the broader implications for economic recovery. Recent data has shown a slowdown in private payrolls growth, prompting analysis of the underlying factors influencing this trend.

Several market conditions contribute to the deceleration in private payroll growth. One significant factor is the ongoing uncertainty lingering from various external pressures, including global supply chain disruptions and inflation. Businesses are increasingly cautious about expanding their workforce in light of these uncertainties, leading to a more measured approach to hiring. Furthermore, the tightening of monetary policies has elevated borrowing costs, restricting the ability of companies to invest in workforce expansion.

Additionally, changes in hiring practices have also played a role in the slowdown. Many organizations are adjusting their workforce strategies—prioritizing automation or improving operational efficiency over large-scale hiring. Consequently, this shift can impact various industries differently. For instance, while sectors like technology and healthcare continue to experience growth, industries such as hospitality and retail have seen a more pronounced decline in hiring activity compared to previous months.

The implications of these trends are significant for the overall economic recovery. A sustained slowdown in private payroll growth may hinder consumer confidence and spending, vital components for economic stability. Companies in sectors adversely affected by the slowdown could face challenges in regaining momentum, influencing broader economic performance moving forward.

Impact on the Economy and Future Projections

The recent rise in US jobless claims, coupled with the deceleration in private payroll growth, raises significant concerns about the broader implications for the economy. When jobless claims increase, it often signals underlying weaknesses in the labor market, which can have cascading effects on consumer confidence and spending. Consumer spending is a vital driver of economic activity, accounting for a substantial portion of GDP. Therefore, increased unemployment can lead to more cautious consumer behavior, with households prioritizing savings over discretionary spending, thus slowing economic growth.

Inflation rates may also be impacted by these labor market trends. A slowing job market generally reduces wage growth, which can mitigate inflationary pressures. However, if job cuts lead to increased unemployment rates, there could be the opposite effect on inflation if companies respond by raising prices to maintain profit margins. The overall balance is complex and will depend on various external factors, including global economic conditions and supply chain disruptions.

The Federal Reserve’s monetary policy is another crucial aspect influenced by rising jobless claims and private payroll growth stagnation. In response to labor market deterioration, the Fed may opt for more accommodative monetary policies, such as lowering interest rates or implementing quantitative easing to stimulate job creation and economic activity. Expert opinions suggest that if these trends continue, market observers should expect the Fed to remain vigilant, adjusting its strategy to foster economic stability.

Looking ahead, forecasts remain mixed. Some analysts project a potential rebound as companies adapt to changing economic conditions and seek to hire amidst a competitive labor environment. Others caution that if jobless claims persist at elevated levels, it may lead to a prolonged period of economic uncertainty, affecting projections for growth in the upcoming quarters.

Conclusion: What Lies Ahead for the Labor Market

Recent trends in jobless claims and private payroll growth have painted a complex picture of the U.S. labor market. The increase in jobless claims signals potential challenges for both job seekers and employers. This rise can be attributed to a combination of factors, including economic uncertainties, industry restructuring, and shifts in consumer behavior. Private payroll growth has also shown signs of deceleration, suggesting that businesses may be adopting a more cautious approach in hiring practices amid an evolving economic environment.

In the short term, the labor market may continue to experience fluctuations, impacting job availability and unemployment rates. For individuals, this may necessitate a proactive approach to skill development and job searching. Emphasizing versatility and adaptability will be crucial as workers navigate changing industry demands. Meanwhile, businesses may benefit from reevaluating their hiring strategies and exploring innovative approaches to workforce management. This includes investing in training and upskilling programs to enhance employee resilience and productivity.

Looking towards the long term, the evolution of the labor market could lead to new opportunities. Economic recovery phases tend to create demand in various sectors, particularly those focusing on technology and sustainability. Businesses that remain agile and forward-thinking are likely to capitalize on emerging trends, thereby fostering growth and stability. Additionally, collaboration between public and private sectors can play a pivotal role in creating a support system for workers, including job placement programs and resource sharing.

Ultimately, adaptability will be a defining characteristic of a successful labor market. By remaining informed about economic shifts and actively enhancing their skills, both individuals and businesses can better navigate the complexities of the labor market in the years to come.